These days the Van Diemen’s Land Company (VDL), now a leading milk supplier, is in the vortex of both a global rush to invest in food supplies and a new economic narrative in Australia. The “dining boom” is a high-value, high-employment alternative to the busted minerals and energy bonanza. Exports of processed food, beverages and fresh produce hit nearly $27 billion in 2014–15: a rise of nearly $4 billion from the previous year, helped by a weaker dollar. These industries already employ nearly 300,000 people. With Asia’s middle classes growing, the prospects look bright.

In 1993, VDL’s British owners (successors to the London investors given some 350,000 hectares of unmapped land by King George IV in 1825) sold out to a company in New Zealand, which in turn passed the business to the district council of New Plymouth, on the country’s North Island, in 2008. It was not the wisest investment for the council, putting two-thirds of its perpetual investment fund in a single overseas outfit that produced a single commodity: milk. Two years ago, the council made it known it was open to offers.

Last November, Launceston entrepreneur Rob Woolley thought he had a deal for his listed company TasFoods to buy out VDL for $250 million in cash and shares. The largest single milk producer in Australia, with 19,000 cows producing about 1% of national output, VDL was potentially a good fit with another part of Woolley’s business group, the infant formula and baby food company Bellamy’s Organic, also based in Launceston.

But developments far away had made VDL into hot property and brought unexpected competition.

In China, dairy consumption had been growing by nearly 13% a year since 2000, encouraged by a government that saw a higher calcium intake as a means to produce a population as big and strong as Westerners. “My dream is that each Chinese person, and especially the children, can afford to buy one jin[500 grams] of milk to drink every day,” said the then premier, Wen Jiabao, in 2006.

China’s astonishing growth was meanwhile drawing more women into the workforce, often in factory zones far from the family home. Most of its workplaces expect a mother to be back at work two weeks after giving birth. The rate of exclusive breastfeeding for infants younger than six months dropped to 28%, far below the global average of 40%. Reliance on tins of infant formula grew and grew.

Chinese buyers turned up at farm gates in places like Leongatha, in Victoria’s Gippsland region, offering to buy breeding cows to increase the yield of China’s domestic herd. In 2012 alone, China imported 100,000 cows from around the world. But its domestic producers still struggled to keep up with demand and faced fierce competition from foreign suppliers of milk powder, some derived from subsidised farms in Europe. The result was downward price pressure on China’s dairy farms, most running just a few cows each, and a temptation to cut corners.

Sometimes it was just watering down milk to increase volume. Then, in 2004, Chinese media reported that at least 13 infants had died in Anhui province after being fed fake formula produced in 141 factories. Many of the infants seemed to have abnormally enlarged heads; in reality, their bodies had shrunk – in some cases, below birth weight. Authorities in one city, Fuyang, had known about the problem for nearly a year before publicity forced them to act.

This “big head baby” scandal was followed by an even bigger one in August 2008, just as Communist Party rulers were revelling in the spectacle of the Beijing Olympics. The New Zealand dairy company Fonterra became aware that products made by its 43%-owned Chinese partner Sanlu contained melamine, an industrial chemical used to make plastics and glues. Poured into milk, it gives the appearance of more bulk and protein. Fed to infants in formula bottles, it causes kidney stones.

Fonterra urged Sanlu to recall its products. Food safety authorities prevaricated: the Olympics were on. It was not until a phone call from New Zealand’s then prime minister, Helen Clark, to Premier Wen, two weeks after the games finished, that Sanlu announced a recall and a government investigation began. At least six children had died and 30,000 others had been made severely sick with kidney stones and other organ damage. China’s other three dairy giants, including Olympics, sponsor Yili, were found to have the same contamination problem.

The usual scapegoat trials, resulting in the execution of a dairy farmer and a milk salesman, and jail sentences for a number of dairy industry managers, failed to restore confidence in Chinese formula brands. Even now, Huang Lisha, 36, the mother of a ten-month-old boy in Beijing, says she won’t buy a domestic brand. “I’m not assured of the sanitary conditions of cow farmers, additives in animal feed, use of antibiotics, pollution of water, land and grass, and production conditions of dairy companies in China,” she told me via a mutual Chinese friend. She buys Nutrilon, made from Dutch milk for the French multinational Danone, through the manufacturer’s website, at ¥318 (A$68) a tin for delivery by parcel post.

For some years, Chinese emigrants, tourists and students have been clearing supermarket and pharmacy shelves of multinational infant formula brands around the world, either posting them or carrying them directly to family and friends.

Traders in Hong Kong and southern mainland China have run a “grey market”, importing infant formula and frozen beef via Vietnam, disguised with the help of bribed officials, to take advantage of China’s free-trade arrangements with South-East Asia, adding the fee of HK$10 ($1.80) per tin of formula for this border-crossing. Others break up large shipments in Hong Kong and get multiple “ant smugglers” to walk small quantities through customs into Shenzhen, for a typical fee of HK$20 a tin.

More legally, small traders in Australia and elsewhere known as “consolidators” or “aggregators” assemble small purchases from local supermarkets and chemists into consignments to post to China, where online sales on sites like Taobao.com can fetch three times the original retail price. Until recently, Chinese authorities had not enforced product registration and duties on this kind of trade.

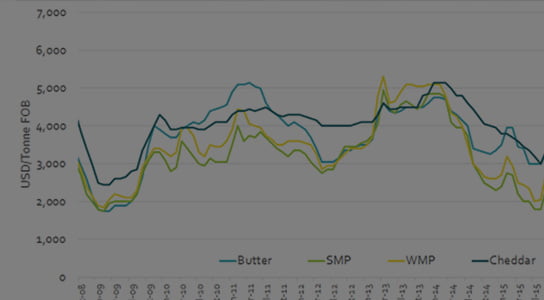

The effect has galvanised interest among Australian investors in the once unglamorous dairy industry. Deregulation in 2000 ended state government-guaranteed prices, causing many small farmers to sell out. But for about two years dairying has been the hottest section of the food industry, marked by company floats, mergers and takeover battles.

China’s discredited milk companies sought out overseas supplies and brands to look as foreign as possible. They and other foreign investors competed with local groups, some with little or no dairy experience, and started buying up farms. In 2014, Canadian milk company Saputo took over Warrnambool Cheese & Butter, the oldest dairy processor in Australia, for $500 million, following a bidding war with Bega Cheese and Murray Goulburn. New Zealand’s a2 was listed in Australia last March and was the target of a takeover bid by gluten-free specialist Freedom Foods three months later. Last October, Blackmores, a Sydney-based maker of vitamins, announced plans to add infant formula to its products in a tie-up with the Bega, and its share price shot up from $45 to $220 (since falling back to around $160 recently).

Bellamy’s Organic was taken over by Rob Woolley’s TasFoods and then floated in August 2014. Its share price rose from around $1.40 just after listing to $13.45 in January this year. The company has just reported an 83% jump in sales for July–December 2015 over the same period in 2014, with net profit up 325%.

A succession of events in October and November stymied TasFoods’ purchase of VDL. First, the Chinese government, trying to slow the rapid ageing of its population, changed its one-child policy to allow couples to have two children. The approach of the auspicious Year of the Monkey suggested an imminent surge in births.

Then, just after Woolley reached an agreement on VDL’s sale, an annual Chinese gift-giving event on 11 November brought it all home to Australian shopping centres. Members of the Chinese community cleaned out many local shops and pharmacies of infant formula (an odd choice for an event titled “Singles’ Day”) to send to China. Facing a backlash from local parents, Australian retailers joined counterparts in places like Hong Kong and Germany in rationing sales to a couple of tins per purchase.

Woolley found himself gazumped by Lu Xianfeng, whose Ningbo Xianfeng New Material Co. Ltd is valued in China’s share market at about $1.5 billion. Lu’s company Moon Lake Investments offered $280 million for VDL, an offer the New Plymouth councillors felt they had to accept – even though Lu’s main Australian investment before this had been a sun blinds manufacturer, Kresta. Woolley went to the Victorian Supreme Court, arguing the council had reneged on a done deal, but failed to get a stay order on the sale; the judge said that while TasFoods could go to trial, its case didn’t look strong.

Meanwhile, Bellamy’s is scaling up its own operations to take advantage of the growing Chinese demand. Though the company has been selling directly to Chinese consumers through a “flagship store” in Alibaba’s Tmall online service, founder and chief executive Laura McBain estimate 30–40% of Australian retail sales are still going to China.

Bellamy’s is outsourcing production of formula to Australian mainland factories operated by Murray Goulburn and a joint venture of Fonterra and Chinese partner Beingmate. But where do the organic milk supplies, free of chemicals and antibiotics, come from?

“If we took the entire Australian organic supply of milk – and that includes all the milk being sold as fresh milk, cheese and yoghurt and everything – it would actually only last us a month and a bit,” says McBain. “The opportunity for us is to create at least that amount of supply [again] in the Australian market. In the meantime, we’re working with existing organic farmers globally to supply the immediate demand for Bellamy’s products.”

It’s an expensive business, paying three years’ worth of subsidies for farmers to convert to organic methods, and then paying premium prices for their milk. Tasmania, with its high rainfall, clean air and uncontaminated soil, is a “logical” place to look for more organic milk, according to McBain.

Lu Xianfeng had to apply to Canberra’s Foreign Investment Review Board (FIRB) for approval to buy VDL, while a nationalist campaign grew against this Chinese take-over of a company that had never actually been Australian-owned in its 190 years.

At the end of February, Treasurer Scott Morrison announced FIRB approval of the purchase. He noted Lu’s promises to keep all staff, undertake a number of investment projects in the VDL farms, avoid transfer pricing, allow Aboriginal people to visit traditional sites, and even build a “devil-proof fence” to keep out Tasmanian devils that might carry the face-eating disease ravaging the species elsewhere. (Lu has also offered up to 50% equity to local investors.) If the government acceded to the demand to block the sale, Morrison said, “no investment tender process could be taken seriously again in this country”.

For his pains, Morrison was immediately lampooned in Sydney’s Daily Telegraph, pictured with his hands to the udder of a cow, under the headline ‘Milking Us Dry’. His imminent approval of the sale of the sprawling S Kidman & Co cattle ranches in central Australia to the Shanghai Pengxin group was foreshadowed as another sell-out.

This anti-foreign investment claque is selective. Tamar Valley Dairy’s sale to Fonterra didn’t raise a ripple, nor have sales of food producers to European groups like Italy’s Parmalat. However, the VDL sale does raise some questions.

One in particular to the company. Can Lu’s marketing expertise from sunblinds translate into the food business in China? “It’s his home market and one he knows from supplying other products into it,” says VDL’s David Beca, mentioning the possibility of branded milk products. Yet the toxic image of Chinese businessmen among their compatriots suggests Lu himself might have to stay in the background.

Other questions relate to the nature and extent of the dining boom, and who benefits from it.

Around half of the Australian agribusiness (first-stage processing of farm produce) is already in foreign hands. In addition, Chinese and Gulf investors are buying outback cattle spreads like Kidman. Leading manufactured food brands from Vegemite to Tim Tams are owned by multinationals. A global investment rush on food was inspired by the trope of a world population growing by 3 billion this century, more people moving into the middle classes of emerging economies, and falling areas of arable and grazable land in many countries due to urbanisation, desertification, salinisation, contamination and erosion.

Second-tier brands attract takeover bids almost as soon as they emerge. Last September the Hong Kong-listed Biostime, controlled by interests in nearby Guangzhou, paid $1.67 billion for 83% of Swisse, which began in a St Kilda naturopathic shop in 1972. Its vitamin and diet supplements have been the target of another Chinese buying frenzy.

With this weight of money, can companies like Bellamy’s or Blackmores avoid a takeover? So far informal traders and operators in the grey market have scooped up a third or more of the price difference between domestic sales and potential exports. The new China–Australia Free Trade Agreement (ChAFTA), which took effect in December, has promised stricter product licensing by Chinese authorities and lower tariffs. Who will gain the profits from scaled-up production and the new trade regime?

Australia is not short of innovative food producers to tempt foreign investors. Adelaide’s Beston Global Food Company is building what it says is a “closed-loop supply chain” into Asian markets from its own dairy farms, oyster beds, its lobster, tuna and kingfish catchers, and a laboratory developing alternatives to sugar, salt and fats in food processing.

In Western Australia’s wheat belt, growers have been experimenting with the “superfood” quinoa to show that it can be produced in low-altitude broad acres as well as the high Andes. Australian Grown Superfoods has set up a quinoa processing plant on co-owner Ashley Wiese’s farm near Narrogin, with part-financing from Coles. Another enthusiast, Steve Timmis of Australian Quinoa, thinks Australia alone could double world production, currently 100,000 tonnes, within five years.

Exportable brands are developing out of small enterprises that until recently just supplied local farmers’ markets, restaurants and tourist shops. Domestic olive oil producers make about 18 million litres a year. About 60% contributes to Australia’s 45-million-litre annual consumption, and 40% is exported, mostly to Asian countries. Big brands, including Cobram Estate, last year won medals in a New York tasting competition. The same is happening with many other niche items, like almonds and truffles.

With listed companies, current high valuations provide some protection from corporate takeovers and buyouts. In late 2013, American private equity funds KKR and Rhone Capital were talking of a $5.20-per-share takeover of Treasury Wine Estates, whose brands include Penfolds and Wolf Blass. Since then, strong sales for its wine into China, even ahead of ChAFTA, have lifted Treasury Wine Estates’ profitability. Its share market valuation jumped $1 billion in a day this January, with the share price now above $9.

Aside from challenges related to production and ownership, exporters have to keep control of their distribution chain, hardest of all in China. Issues aren’t limited to unauthorised re-selling. In November a Chinese government report said 40% of goods sold online in the country were fake or of poor quality. Penfolds wine and Farmer Brown’s milk are trying to wrest brand names from trademark squatters. Treasury Wine Estates is said to snatch back its empties after wine tastings to limit copying of labels.

Exporters can’t just ship and trust. Beston Global Food Company sells into China via Walmart-controlled online supermarket Yihaodian, which claims 57 million customers. It also has dedicated sections in the 200-store supermarket chain Dashang, its own distribution company, and an app for buyers to tap their mobile phones against a Beston product’s QR code or barcode and trace its origin. “Companies like that will do well because they control the business,” says Karim Takieddine, whose Sydney-based Gourmet Foods of Australia has been exporting processed foods and farm commodities for two decades.

Bellamy’s Organic has had an office in China since 2012. According to Laura McBain, tighter product registration, the rise of big e-commerce networks, and importation through new free-trade zones are reassuring buyers that the product is genuine. She says the brands that have “real credibility and [have] clearly demonstrated their willingness to participate with the authorities up there, and work with them in a logical way, will be the companies that survive”.

But Michael Clifton, the Australian Trade Commission (Austrade) country manager for China, tells a story illustrating the trust deficit to be bridged in China. “I was once in a room where a young Chinese lady stood up and said, ‘Can I trust the Australian infant formula that is available on Alibaba’s Tmall here in China?’ I said, ‘Of course you can.’ She responded, ‘My husband will not allow me to buy Australian infant formula online in China because he will only trust the infant formula that comes out of a box that’s been shipped to the family address by a Chinese student in Sydney or Melbourne.’”

Localised labelling is actually a turn-off in China. “It’s got to be predominantly in English,” says Rob Gregory, whose Melbourne-based Australian Fine Foods has been exporting Australian products into Asia for 25 years. “It’s got to be presented as an imported product, especially with dairy. If they see a label fully written in Chinese they won’t look at it.”

“In China, they want what’s on the shelf here,” adds Gary Dawson, chief executive of the Australian Food & Grocery Council in Canberra. “The mark of authenticity is the Coles or Woolworths receipt or the Chemist Warehouse checkout receipt.”

Though companies are reluctant to concede it, much of their brand awareness and market in China grew without their effort. China provides the biggest number of foreign students and tourists coming to Australia. The sample and take back wine, honey, vitamins, food supplements, cosmetics, lavender pillows and a range of things locals wouldn’t think about. Old-fashioned lanolin skin cream, for example, is abundant in souvenir shops for Chinese tourists.

Of course, however tempting it may be, companies can’t entirely abandon or squeeze local customers to chase a market that could be choked anytime by one of China’s notoriously sudden bureaucratic fiats. In the meantime, the power of arbitrage is not just a fact of life at the baby-bottle end of the food market. If enough of the new rich in China and elsewhere will pay $1000 for a bottle of the new Penfolds Grange, that’s what domestic customers will pay – or see it vanish into the grey market.

Chinese consumers’ demand for infant formula, vitamins and “nutraceuticals” reflects their concern for health and wellbeing. They are aware of toxic levels of pollution in their air, and in the soil and water in which domestic food supplies are grown and produced.

“Every 750-millilitre bottle of our olive oil has $9 worth of free nutritional additives in it,” says Rob McGavin, chief executive of Boundary Bend. Its Red Island brand sells well in China. “There’s a big health angle, and there’s no doubt Asians are aware of it.” The purity and traceability of Australian olive oil products are eroding the cachet long-held by Italian, Greek and Spanish oils, whose reputations have been so damaged in export markets by “counterfeit” olive oils.

Even red wine is marketed as a health product, says Zhang Jinghong, an anthropologist of food and consumption culture at the Australian National University. “Because traditional Chinese medicine views different foods as having different intrinsic properties capable of ‘nourishing life’, wine has come to be seen as having its own set of healing properties. Hence sales promotions for red wine in China tend to highlight its positive effects on a person’s health, with the prevention of cardiovascular disease, anti-fatigue and anti-ageing properties frequently listed.”

The honey-producing Charles family in north-western Tasmania have found that their Blue Hills Leatherwood, manuka and wildflower products are going not to Asia’s supermarkets and groceries, but to its pharmacies, herbalists and beauty parlours. “The first question from customers is ‘What’s the function?’,” says Nicola Charles. “They want to know everything about the product, the provenance, its medicinal properties, its antioxidant capacity, its ability to kill bacteria, its anti-inflammatory potential. Not just that it tastes good or the flavour. ‘How’s this going to be good for my body?’”

That’s also good for the prices: in Hong Kong, Blue Hills can get $25 for a 250-gram jar of its manuka honey. In Singapore, at a new store where customers can get their irises to read and need for tonics assessed by staff naturopaths, Blackmore’s charges S$100 ($98) for a one-hour session – redeemable against products.

This may all suggest a health and beauty craze, more than the feast of epicurism contained in the term “dining boom”.

Austrade’s Michael Clifton sees in China a widening of food taste too. The phenomenal growth in the sales value and volume of meat, wine and dairy point to a rising consumer class in China, he tells me. “They have the disposable income that allows them to afford the sorts of things their sons and daughters are seeing back in Sydney and Melbourne, and their friends have seen on trips to Australia. Tourism and students are part of the equation, but not the full story. It’s rising incomes in China and an aspirational middle class.”

ANU’s Zhang Jinghong notes how China’s tradition of connoisseurship in tea is translating into an appreciation of red wine, which China now consumes in greater volume (1.9 billion bottles in 2013) than the French (1.8 billion bottles in the same year). Drinking foreign beverages is a mark of success, she says. “Wine moreover is loosely equated with Western civilisation, just as tea represents Chinese civilisation,” she says. “Therefore many middle-class Chinese see wine-drinking as a means of understanding the Western way of life.”

Chinese consumers will choose foreign wine over the many brands made in China’s north. Bordeaux and Burgundy from France are their first choices, but Australia is valued for a “New World” wine offering an alternative taste. Australia’s wine producers sold the equivalent of 79 million bottles into China in the year last September, second only to France.

Western-style wines are favoured for slow sipping in homes or out with friends, particularly among women, following a trend already established in Japan and other Asian centres of prosperity. This is a contrast to the rowdy male milieu of China’s “banquet culture”, where puce-faced hosts challenge guests to drink-it-down toasts with sorghum spirit. “You don’t want them to do that with Grange,” says former Austrade economist Tim Harcourt, now at the UNSW Business School. He notes that Penfolds’ chief winemaker, Peter Gago, has made a “quite ceremonial” program for his tastings in China.

It’s all part of Australia’s gradual shift away from a commodity-based agricultural trade, one in which government marketing boards sold grain, meat and dairy products in bulk, and no one else bothered much about exports. Gourmet Foods of Australia’s Karim Takieddine recalls a great “laziness” when he came to Australia in the mid-1990s to scout for farming trade and investment opportunities. “At the value-added end there was a complacency,” he says. “Because if you had 10% of the Australian domestic market it was a reasonable turnover for a family business.”

Further big attitudinal shifts still seem required. The free-trade agreements recently signed with China, South Korea and Japan lower customs barriers, but Australian Fine Foods’ Rob Gregory says earlier FTAs in South-East Asia had typically been thwarted by bureaucratic obstacles thrown up to extract fees or protect local producers. “Free-trade agreements are fine, but they have to be enforced and dealt with in the spirit with which they’re signed,” he says. “Not just as a piece of paper for politicians to wave around.”

Bulk farm trade still has huge institutional support, through bodies like Meat & Livestock Australia, the National Farmers’ Federation and, in the political realm, the National Party. Big companies can afford an overseas presence and feel they can call in government help, as Treasury Wine Estates chief Mike Clarke did recently when he complained publicly that his shipments into China were taking four months to clear customs despite the new FTA.

Small-scale producers, among them the most high quality and innovative in their markets, still often feel ignored. In a review of submissions to a recent Senate rural affairs committee inquiry on the wine industry, Macquarie University accountancy academics Roger Burritt and Katherine Christ noted small winemakers felt “invisible” to wine industry bodies.

Exporters have mixed feelings about Austrade. For some years the budget of its Export Market Development Grants to help small and medium companies haven’t been higher than around $138 million, shared among more than 3000 successful applicants annually. “Austrade has been cut to a minuscule department. They can’t even take a potential client out for a cup of coffee,” says Rob Gregory. “We’re on our own out there.”

It’s an old dilemma for developing Australia. While in Smithton, I went into the Circular Head Shire library to look for a history of VDL. In a booklet published in 1958, I found a reference to a forlorn attempt by Hobart authorities in 1825 to head off the huge land grant being fixed up in London. They wanted the northern coast settled by small agriculturists rather than what they described as “large capitalists”.

But how do small producers get their goods to distant markets? Similar issues remain.

More Australian companies are opening offices in Asia. Austrade has a detailed brochure on how to tap into China’s online market, where sales totalled the equivalent of half a trillion Australian dollars in 2014. But as with the spontaneous trade-in formula and vitamins, much of the best export promotion so far has come as an accidental spin-off – from students home after studying in Australia and from immigration. “One in four Australians, two-thirds of our entrepreneurs and one in two of our exporters are born overseas,” notes UNSW’s Tim Harcourt.

Investment in rural start-ups is a comparatively new thing for Australian capital markets. “We’ve had a strong economy for 25 years, and Australia’s had an investment propensity for blue chips and red bricks,” says Harcourt. “You go big companies like BHP Billiton, Woodside or Rio investments or you go property. Being a globally focused entrepreneur, focused on Asia, is quite a big risk.”

The recent share market rush into dairying and other agribusiness raise concerns for VDL’s David Beca, who says farming requires “patient” capital.

“Quite often, the least successful is a listed company investment because it’s very rare these days for shareholders to be prepared to wait longer than a year without a dividend.

“With large numbers in developing countries moving into the middle class over the next 30 or 40 years, agriculture will be more reminiscent of some very good periods back in the ’50s and ’60s. But it’s a long-term trend, and when you have a couple of years when people get over-excited that’s when you have poor decisions being made.”

Then there’s the “behind the frontier” task of linking products with national cultures. Most marketing analysts think Australia has greatly improved its trade sophistication but hasn’t yet matched the highly successful “100% Pure New Zealand” brand that pulls together tourism, produces and services.

“When national branding is done well, first of all, it is authentic, it’s true, and second it’s able to be transferred across different products, or even into the soft diplomacy that you’re a good country to deal with,” says an admiring Chris Styles, a marketing specialist and dean of the UNSW Business School.

“New Zealand does it ten times better than Australia, and Tasmania does it ten times better than the mainland, and King Island ten times better than Tasmania,” agrees Boundary Bend’s Rob McGavin.

Australia has strong profiles in education, tourism, products and services, and has had global celebrities from Paul Hogan to Nicole Kidman for endorsements, but no such unifying theme yet. Austrade tries with “Australia Unlimited”. It hasn’t caught on.

“Our branding issues go hand in hand with our identity as a country, which we are still grappling with,” says Gourmet Foods of Australia’s Karim Takieddine. “Are we a republic? Are we a Commonwealth country? We are still emerging as a country. The Opera House and the Australian kangaroo have been pushed enough. It’s time to start doing something elegant.”

Nearly everyone contacted for this article named the elements of the national image for food exports as “clean”, “green”, “traceable” and “safe”. Being a remote island continent is helpful, the irksome quarantine barriers are now positive.

“Our use of chemicals and fertilisers is very closely monitored and by world standards, we are pretty good,” Takieddine says. “For example, when we export to Japan or Taiwan we have to test for a list of about 1000 heavy metals, fertilisers and chemical residues, and I don’t think we’ve ever had an issue. It’s quite an expensive process, but by world standards, our processes are clean and green. There are only two crops that are allowed GMO: cottonseed and some canola, maybe now some soya. That’s a big card for us.”

Australia had its last big scandal in food security in the early 1980s when an abattoir filled out a beef shipment to the US with kangaroo meat, then more pet food than a lean gourmet item. The industry’s reputation recovered, and it was able to take advantage of the Asian bans imposed on US beef during 2003–08 because of an outbreak of the so-called mad cow disease. But the scandal showed how a brand can be shaken overnight. In 2013, New Zealand’s Fonterra made a worldwide recall of products when a test showed, falsely as it turned out later, that a consignment of whey protein concentrate contained botulism.

The clean, green image also looks somewhat hypocritical for many of the figures who claim it for Australian agriculture. National Party politicians and members of the National Farmers’ Federation were feeble about coal leases and gas in prime farm regions like the Liverpool Plains, the Hunter Valley, the NSW North Coast and the Darling Downs. They were also at the forefront of campaigns to end carbon pricing. Tasmania’s Liberal premier Will Hodgman joined in, even though, as Greens senator Peter Whish-Wilson points out, his state stood to gain huge revenues from its past investments in hydroelectricity and other renewables.

Analysing submissions to the Senate’s wine inquiry, Roger Burritt and Katherine Christ was surprised by the way the industry body ignored the climate-change issues, which could threaten their vision of growing exports. “Environmental sustainability in the context of extreme weather events, changing season lengths and water shortages may well stymie the short-term economic gains about which Wine Australia is currently in awe,” they wrote.

On the road up to Blue Hills Honey in the Tasmanian hamlet of Mawbanna in mid-February, I drove past what I took to be a gully of dead trees before realising it was a dried-out dam. Up ahead, huge clouds of smoke billowed over the Tarkine wilderness. A huge DC-10 air tanker made passes over the hills, trying to stop bushfires that had raged for a month. By mid-March, the fires were dying. In the Circular Head municipality alone, encompassing Smithton and Mawbanna, 17% of the total area was burnt. The damage in other shires covering parts of the Tarkine was still being assessed. Luckily, Blue Hills found that all of its 1700 hives out along forest trails had survived.

The west side of Tasmania had the driest October since records started. A scorching summer reduced Hydro Tasmania’s dam levels to 20% of normal. The state was importing electricity from Victoria until the Bass Strait cable link broke just before Christmas, resulting in power rationing for industries and the rushed importation of diesel generators. Along the east coast, unusually warm waters caused by the strong El Niño in the Pacific had allowed a virus to flourish that ravaged commercial oyster beds.

Cape Grim itself has suddenly become emblematic, both for the worldwide scientific community engaged in charting climate change and for those concerned that Australia’s food-growing potential might fall or change shape drastically, cutting off a boom.

When I went out to Cape Grim with VDL’s David Beca, smoke from the burning Tarkine had swung around and covered the area. We could hardly see an array of wind turbines to the south or the small islands off the cape. Close up was a squat building and a communications tower, the Baseline Air Pollution Station. It’s one of three in a worldwide network to provide a minimal pollution reference for measuring greenhouse gases in the atmosphere. Businesses in the area have used the presence of this station to boast that their honey bees or Wagyu cattle thrive in “the cleanest air in the world”.

In early February, Larry Marshall, the former Silicon Valley tech entrepreneur appointed head of the Commonwealth Scientific and Industrial Research Organisation under the Abbott government, announced that CSIRO would be shedding 350 staff. Among them would be half to three-quarters of the climate-science specialists, who analyse data from Cape Grim and elsewhere. Climate change was a known fact, said Marshall, so it was time to work on profitable solutions.

I asked several business people whether the drought and oyster disease were shifting Tasmania’s political outlook away from its notorious bias towards big industry and forestry. Most tried to avoid saying that they were. “I don’t think it’s really sunk in yet,” Peter Whish-Wilson told me, as he helped man the stall for his family’s Three Wishes vineyard at the annual food festival in Launceston. “The politics are still toxic.”

It seems Australia will have to wait for more smoke to see which way the wind of climate change blows.