Dairy analysts watching European weather closely

Brighter prospects of higher Victorian farm gate milk prices, due to a downturn in global milk supply, may be dampened by a sharp jump in production costs, according to analysts.

Dairy Australian senior analyst John Droppert said there had been a drop in New Zealand production and a cold, and wet spring, in the northern hemisphere.

“The Europeans went through quite a bit of fodder, keeping cows indoors, and now they are coming through a hot summer, where they need fodder as well,” Mr Droppert said.

Whilst milk volumes were not yet down, the heat could affect fat and protein levels.

“Fodder shortages are going to bite, later in the season, and milk volumes will drop as heat stress catches up,” Mr Droppert said.

Mr Droppert said buyers would be looking around to ensure supply.

“They don’t wait until there is no product before they start to worry about it,” he said.

“If they see those dry conditions, and those numbers coming in, they start to cover themselves.”

Australian manufacturers were trying to maintain the premium for Australian products and it made it easier to hold out for a better sale when buyers were keen.

Rabobank’s Michael Harvey said expectations for the new season in New Zealand were good, with healthy margins for dairy farmers on the back of milk price signals.

While seasonal conditions in autumn had been kind, the next few weeks would be critical.

Mycoplasma Bovis wouldn’t significantly impact milk production this season.

“Infected farmers have the option to milk through the peak of the season, which many have indicated to do, and then cull their herds in early 2019,” he said.

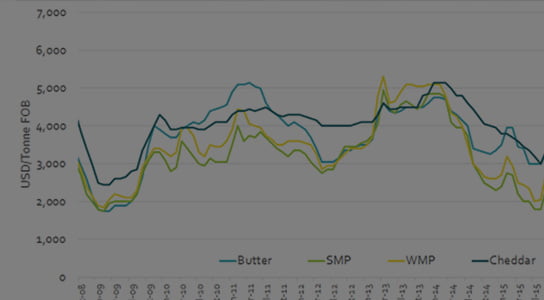

He said global factors pointed to an upswing in prices.

“There is a growing likelihood global supply, in the coming months, could be impacted negatively, which provides an upside to commodity prices,” Mr Harvey said.

“We haven’t seen that realised in terms of higher export returns, just yet, it’s a key watch, right now.

“There is margin pressure because input costs have started to rise, but there is a chance we will see a bit of rally in markets if this weather takes to take a hold of global supply.”

Rabobank was expecting to see production slow, across Europe.

“There are severe drought conditions, in parts of northwest Europe,” Mr Harvey said.

“We aren’t talking about the whole continent, but big areas of Ireland, the United Kingdom and Germany.

“We will probably need to revise down our growth forecasts for Europe.”

The weaker Australian dollar was also supportive of export returns.

“There are some signs on the horizon of higher farmgate prices but it is all quite dynamic at the moment.

“It would be a welcome relief for farmers in many regions given the rising cost of production.”

He said some farmers would be looking to dry off early, or reduce stocking rates, to bring down costs.

Mr Harvey said the dry conditions in the north came as milk production had started to grow again.

“Given the tension in the supply chain that’s a much-needed result,” Mr Harvey said.

Between 2014-15 to 2017-2018, 800million litres of milk were lost in the southern export region, mostly from the north of Victoria.

“The context is we needed to start the recovery, that’s a good first step, but there is still a shortage of milk in the system,” Mr Harvey said.

“This will be a multi-seasonal recovery, given how challenging and tumultuous it has been in the last couple of years.”

In South America, Brazilian production suffered from a large trucker’s strike in late May and although production recovered in June, drought in the southeast was having an impact on production levels.

Rural Bank’s senior analyst Matt Ough said there was a positive outlook for growth and profitability in the sector, tempered by forecast limited rainfall.

Whilst Australian milk supply rose in 2017/18, supply didn’t keep up with demand.

“If the increasing demand for Australian dairy products is met it could equal improvements in farm gate milk prices with a forecasted average milk price of $6.10/kg MS in 2018/19,” Mr Ough said.

He said Rural Bank’s annual review advised global dairy prices should continue to improve with international exports of milk powder continuing to drive value in China and the emerging markets of Thailand and Japan.

Published in News

More in this category: << Dairy Foods, Sport & FitnessDairy Australia promoting dairy on the international stage >>

News - List

Australian food products receive a new look with country-of-origin label

How to shop your groceries like a pro

More support provided to farmers of South-West Victoria

Saputo takes over Murray Goulburn

Australian drought affects agriculture and dairy industry

Understanding Food Labels for a Healthy Diet

Australian Fine Foods CAC HACCPVER:2003 - CODEX HACCP and GMP & ISO 9001:2015

Taste the Australian Food Show - Australian Ambassador to Taiwan ...

New market engagement program trialled in key Southeast Asian markets

Second Taste Australia event showcases premium Australian produce

Australian dairy processors continue to plan for the long term

Dairy Australia promoting dairy on the international stage

Dairy analysts watching European weather closely

Dairy Foods, Sport & Fitness

Dairy Nutrients

Dairy and your Health

Dairy and Healthy Weight

Dairy part of a balance diet

South East Asian Scholarship Program, 2019

2018 Milk Quality Awards

Fonterra makes $165m investment in Australia

Strengthening ties with key markets

The cream of the crop crowned at the Australian Grand Dairy Awards

Dairy Australia activities 2017

Market commentary November 2017

Situation and Outlook June 2017

Dairy Situation and Outlook October 2016

The Dining Boom