Market commentary November 2017

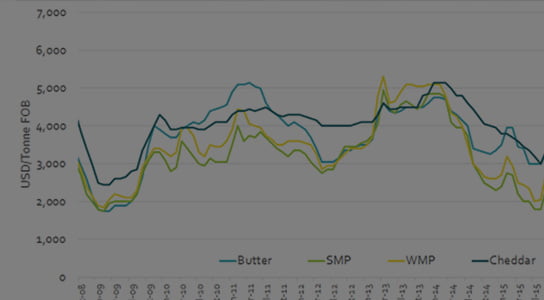

Signs of downward pressure are beginning to emerge in dairy commodity markets. Butter prices – until recently at record highs – have fallen sharply in European markets over the past month. Skim milk powder (SMP) prices remain near 10-year lows, and conflicting signals from the European Commission relating to its 380,000-tonne stockpile have sent jitters through the market. Acceptance of bids at well below market prices small parcels of product and uncertainty about the commencement or duration of fixed-price buying in the new season (from March) are raising fears that the price floor may not be sustained, with the potential flow-on effects for other product prices. The underlying concern, however, is that likely growth in milk production by major exporters will not necessarily be matched by increases in demand – at least in the short term.

Thus far, the global dairy market has benefited from slow growth in milk production across a number of key exporters. In particular, European production remained below expectations due to sub-optimal weather through the northern spring and summer. With incentives to slow milk production expiring and the weather improving, production has seen a boost (even in the Netherlands, where some had tipped a sharp decline). New Zealand remains constrained by wet weather, but with attractive farmgate price forecasts, an acceleration in output for both of these major exporters is a likely reality in 2018. In addition, the US – where production never really slowed – is once again eyeing international markets as their solution to a growing domestic surplus.

The rain-induced slowdown in New Zealand’s milk production hasn’t been enough to stop whole milk powder (WMP) prices from falling in October. Chinese buyers are the primary source of demand, and NZ sellers seem comfortable with sales booked to date. The major unknown remains the timeframe for a recovery in New Zealand’s milk intakes, with year-on-year growth suggested as early as mid-October. Until the data is finalised, buyers seem relaxed.

Cheese prices have remained steady, with European storage volumes dwindling as production trails growth in exports. Whilst European prices have eased, US indicators are currently the lowest, though processors are in no hurry to sell. Increased availability of US cheese is likely, and growing production has already driven whey prices further down

Dairy Australia’s forecast for Australia’s milk production in 2017/18 remains a growth range of between 2 and 3% on the 2016/17 total of 9.02 billion litres. This implies a forecast total of around 9.2 billion litres for 2017/18. Should October intakes show a similar trend to the slower-than-expected production through September (down 0.6%, and season to date growth of 1.0%) a review of this forecast is likely.

Published in News

More in this category: << Situation and Outlook June 2017Dairy Australia activities 2017 >>

News - List

Australian food products receive a new look with country-of-origin label

How to shop your groceries like a pro

More support provided to farmers of South-West Victoria

Saputo takes over Murray Goulburn

Australian drought affects agriculture and dairy industry

Understanding Food Labels for a Healthy Diet

Australian Fine Foods CAC HACCPVER:2003 - CODEX HACCP and GMP & ISO 9001:2015

Taste the Australian Food Show - Australian Ambassador to Taiwan ...

New market engagement program trialled in key Southeast Asian markets

Second Taste Australia event showcases premium Australian produce

Australian dairy processors continue to plan for the long term

Dairy Australia promoting dairy on the international stage

Dairy analysts watching European weather closely

Dairy Foods, Sport & Fitness

Dairy Nutrients

Dairy and your Health

Dairy and Healthy Weight

Dairy part of a balance diet

South East Asian Scholarship Program, 2019

2018 Milk Quality Awards

Fonterra makes $165m investment in Australia

Strengthening ties with key markets

The cream of the crop crowned at the Australian Grand Dairy Awards

Dairy Australia activities 2017

Market commentary November 2017

Situation and Outlook June 2017

Dairy Situation and Outlook October 2016

The Dining Boom