Much of it is catering to the appetite of China’s emerging consumer class, whose tastes are broadening and who are increasingly demanding that their food be clean, green and safe.

One example: the swelling Chinese market for Australian beef. China took less than 1 per cent of Australia’s beef exports in 2010; in 2015, it took 11.5 per cent, even as the price of beef soared to a record A$19.16 a kilogram.

Forecasters at the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) expect the value of total Australian beef exports to top A$9 billion in 2015-16. As recently as 2012, they were barely half that.

The boom extends far beyond beef. Shipments of bottled wine to China grew more than 60 per cent last year; giant winemaker Treasury Wine Estates estimates that Asia will be its biggest single source of profits by 2017. The Californian drought and soaring global demand for almond milk have Australian producers shelling the nut as fast as they can. Honey exporter Capilano can’t get its bees buzzing quickly enough – sales in Asia are growing almost 30 per cent a year.

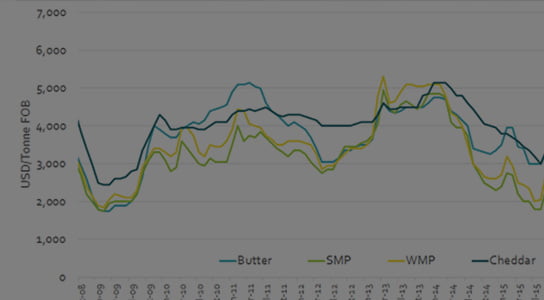

After some tough years for agriculture since prices last peaked in 2011, many of Australia’s export food industries are on the rise.